Abatement Letter To Irs. If you are making a first-time penalty abatement request for. You should always address this correspondence to the Internal Revenue Service and send it to the address listed on the written notice of the tax due: IRS Penalty Abatement Sample Letter Template Sample IRS Penalty Abatement Request Letter.

You may qualify for administrative relief from penalties for failing to file a tax return, pay on time, and/or to deposit taxes when due under the Service's First Time Penalty Abatement policy if the following are true: Facts in your IRS penalty abatement letter to back up the circumstances that you write about in your letter.

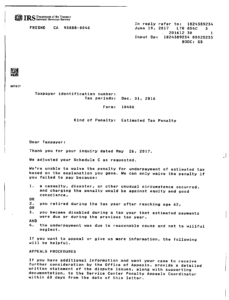

Send the written petition to the address listed on the assessment letter you received from the IRS.

If the taxpayer has a valid reason, these penalties may be appealed with a tax return penalty appeal letter. However, if you want to improve your chances of your request being accepted, you should work with a tax professional. The Internal Revenue Service (IRS) is responsible for charging these penalties for federal income tax returns.