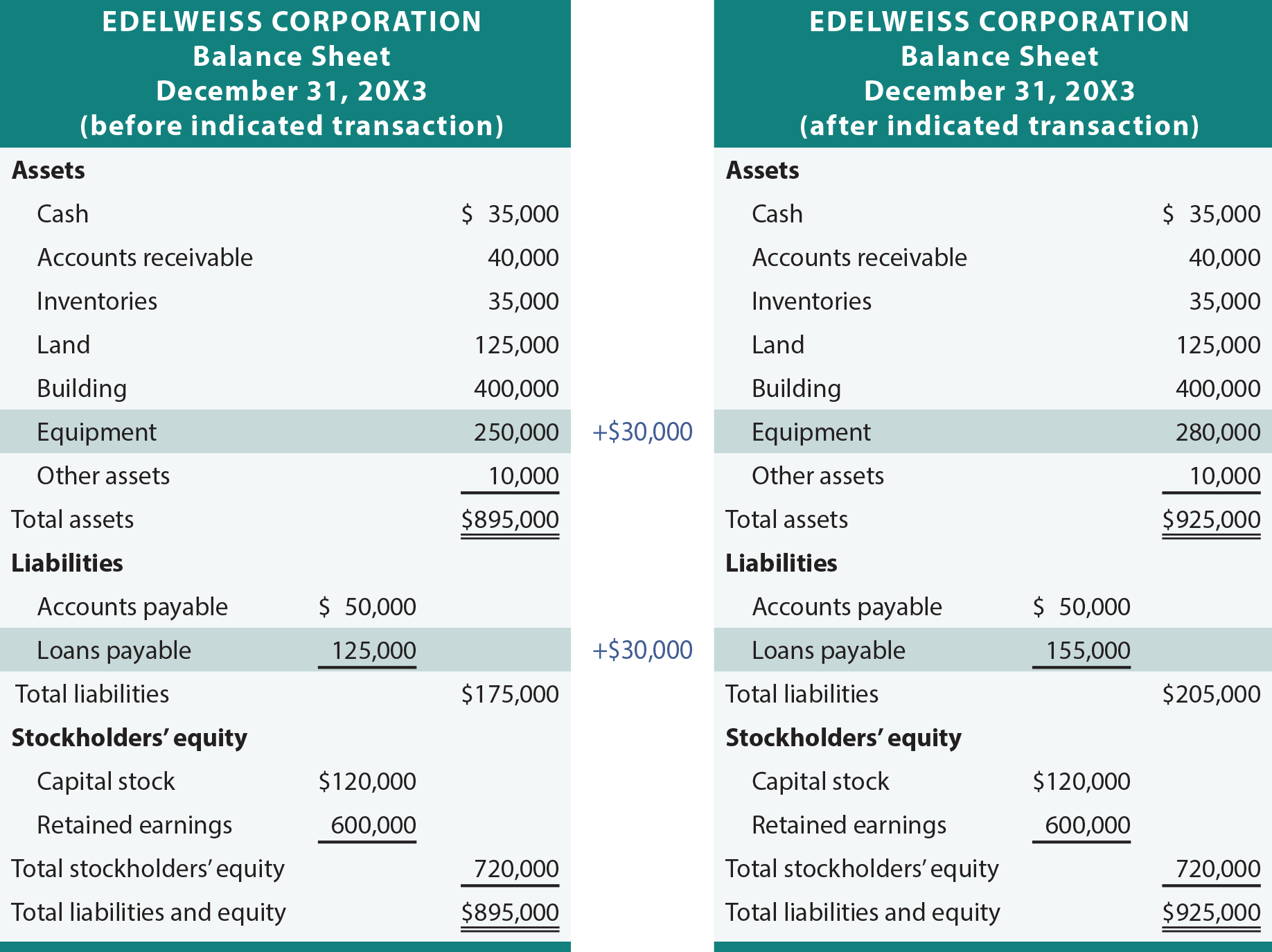

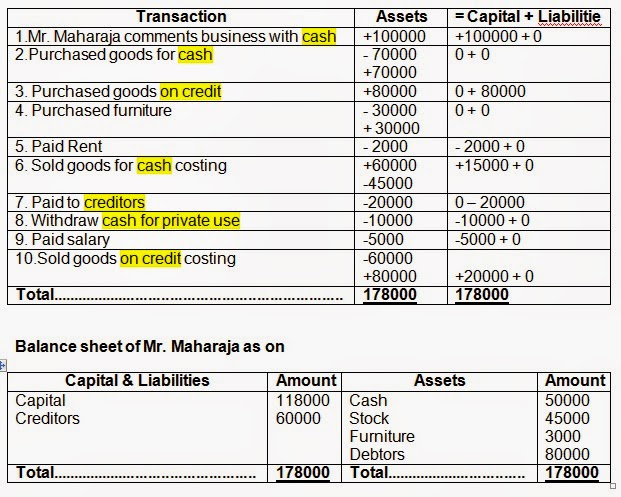

Accounting Equation Balance Sheet Example. The following examples are connected to the same business. Based on this double-entry system, the accounting equation ensures that the balance sheet remains "balanced," and each entry made on the debit side should.

Accounting Equation indicates that for every debit there must be an equal credit. assets, liabilities and owners' equity are the three components of it.

The accounting equation shows that all of a company's total assets equals the sum of the company's liabilities and shareholders' equity.

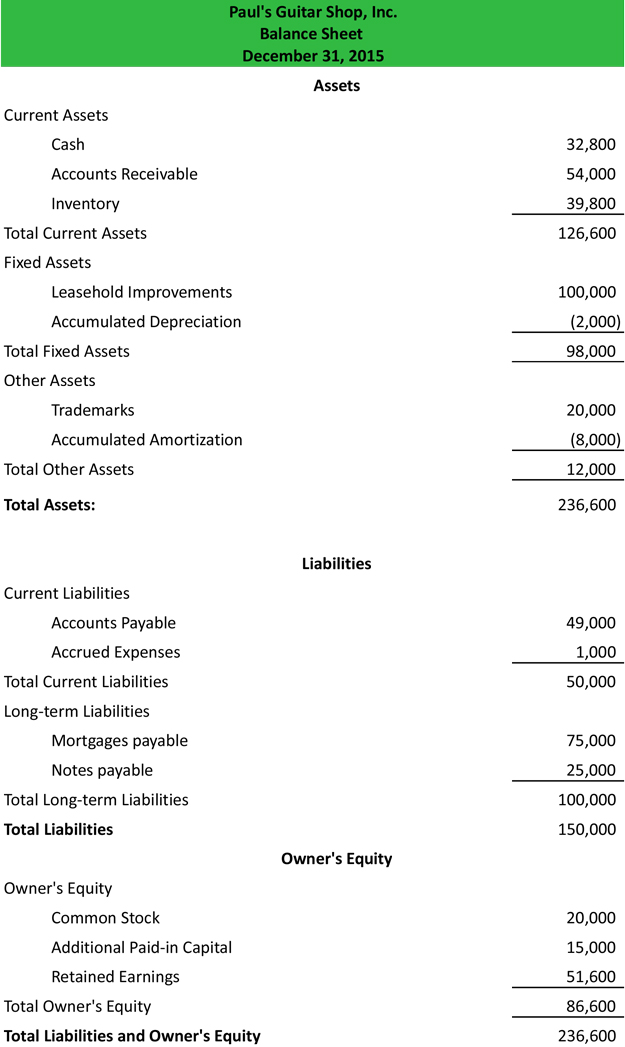

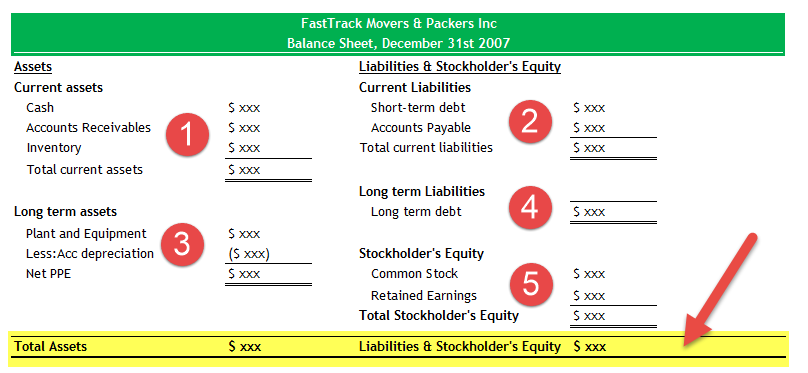

It is to be noted here that the Accounting Equation shall remain balanced every time. This is Assets = Liabilities The balance sheet is created to show the assets, liabilities, and equity of a company on a specific day of For example, any property owned by the company appears here. One type of accounting report is a balance sheet, which is based on the accounting equation: Assets = Liabilities + Owners' Equity.